The Only Guide for Medigap Benefits

Wiki Article

6 Simple Techniques For Medigap Benefits

Table of Contents8 Easy Facts About How Does Medigap Works DescribedExcitement About How Does Medigap WorksThe 25-Second Trick For How Does Medigap WorksThe Greatest Guide To Medigap Benefits5 Simple Techniques For What Is Medigap

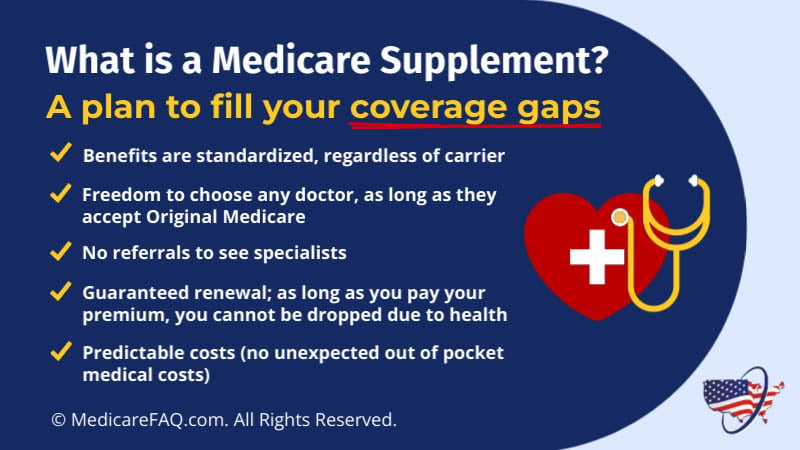

Medigap is Medicare Supplement Insurance that aids fill up "voids" in Original Medicare and also is sold by exclusive business. Initial Medicare pays for a lot, yet not all, of the expense for covered healthcare solutions as well as supplies. A Medicare Supplement Insurance Coverage (Medigap) policy can assist pay several of the staying wellness treatment prices, like: Copayments Coinsurance Deductibles Keep In Mind Note: Medigap intends sold to people brand-new to Medicare can no much longer cover the Component B deductible.Nevertheless, if you were eligible for Medicare prior to January 1, 2020, but not yet enrolled, you might have the ability to acquire one of these strategies that cover the Component B deductible (Strategy C or F). If you currently have actually or were covered by Plan C or F (or the Strategy F high deductible variation) before January 1, 2020, you can maintain your plan.

A Medigap policy is various from a Medicare Benefit Plan. Those plans are methods to obtain Medicare advantages, while a Medigap plan only supplements your Original Medicare benefits.

You pay this month-to-month costs in addition to the regular monthly Component B costs that you pay to Medicare. You can acquire a Medigap policy from any kind of insurance company that's accredited in your state to market one.

Medigap Benefits Fundamentals Explained

A Medigap plan (additionally called a Medicare Supplement), marketed by personal firms, can assist pay some of the health treatment costs Initial Medicare does not cover, like copayments, coinsurance as well as deductibles. Some Medigap plans likewise use insurance coverage for solutions that Original Medicare doesn't cover, like clinical treatment when you take a trip outside the U.S

Keep in mind that you can just have a Medigap if you have Initial Medicare.

10 Easy Facts About Medigap Benefits Described

If you have actually lately enlisted in Medicare, you may have listened to of Medigap plans and also questioned how they work. Medigap plans, additionally understood as Medicare Supplement plans, aid cover some out-of-pocket costs linked with Original Medicare.

When you sign up, your Medicare Advantage Strategy takes control of the management of your Medicare Part An and Medicare Component B protection. Medigaps are planned merely to cover the Medicare costs that Original Medicare entrusts to the beneficiary. If you have a Medigap policy, Medicare pays its share of the Medicare-approved amount for covered solutions and after that your Medigap policy will certainly pay its share of covered advantages.

The regular monthly settlement will differ depending on a number of variables. The most impactful are age, where you live, as well as cigarette use. In 2022 with Strategy F, you can anticipate to pay between $160 and $300. Plan G would commonly range in between $90 and also $150, as well as Strategy N would be around $78 to $140.

Fascination About Medigap Benefits

Enlisting in a Medicare Supplement insurance coverage strategy will aid in covering expenses. Action 1: Decide which advantages you desire, then decide which of the Medigap plan kinds (letter) meets your requirements. Step 2: Learn my review here which insurance business sell Medigap plans in your state. Action 3: Find out about the insurer that market the Medigap policies you have an interest in and also compare expenses.The see finest time to obtain a Medicare Supplement plan is throughout your six-month Medigap Open Registration Duration. The Open Enrollment Duration starts the initial month you have Part B insurance coverage as well as you're 65 or older. Because Medigap strategies are used by exclusive insurer, they are typically allowed to use medical underwriting to make a decision whether to accept your application as well as what your cost will be.

The list below variables can impact the cost of Medicare Supplement plans: Your location Your gender Your age Tobacco use House discounts How you pay When you register Medigap premiums have to be accepted by the state's insurance division and also are established based upon strategy background as well as operating expense. There are three scores utilized that can affect your rates and also price rises.

Issue Age does not suggest the strategy will not see a price increase. You will usually pay more when you're more youthful however much less as you age.

Getting My Medigap Benefits To Work

Still, the cost will certainly boost quicker than the concern age. Area Rated: Area ranking suggests every person in the area pays the very same price. These are generally extra pricey browse around this site when you begin yet will level out in time. A lot of states and service providers utilize the acquired age ranking when valuing their Medicare Supplement insurance coverage.Report this wiki page